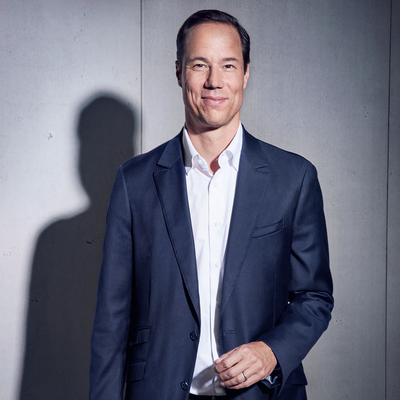

Born in 1980, Spokesman of the Board of Management since March 2023; Member of the Board of Management since March 2021; appointed until end of February 2026.

Tom Alzin joined Deutsche Beteiligungs AG in 2004 and became a Managing Director in 2011. He has 18 years of experience in the private equity business.

Tom Alzin holds a degree in Business Administration from the HEC Lausanne, and also studied at the London School of Economics and Political Science.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads