2023

DBAG agrees strategic partnership with ELF Capital Group

DBAG agrees a strategic partnership with ELF Capital Group, thereby expanding its range of flexible financing solutions (private debt) for mid-market companies.

2021

DBAG Italia s.r.l. founded

DBAG has arrived on the Italian private equity market as a provider of private equity: From Milan, investment managers identify investment opportunities, structure transactions and accompany portfolio companies in their further development.

2020

Final closing of DBAG Fund VIII

1.1 billion euros for investments in German ‘Mittelstand’ companies, high financial capacity due to fund structure and six-year investment period. Equity investments of between 40 and 100 million euros (with the top-up fund up to 220 million euros)

2017

First investments by DBAG Fund VII

Equity capital investments of up to 200 million euros for a management buyout

2016

Strategic alignment

Broader range in the market with equity capital investments of between 10 and 200 million euros; growth slated for DBAG through higher investments alongside DBAG Fund VII (fund size incl. DBAG co-commitment: 1,010 million euros); new dividend policy and capital increase

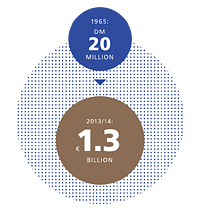

Development of assets under management or advisory by DBAG from 1965 to FY 2013/2014

2015

50 years of DBAG, 30th anniversary of DBAG’s ipo

2012

Largest Fund for investment in german mid-market companies

DBAG Fund VI raised with commitments of 700 million euros (incl. DBAG co-commitment) for MBOs

Today, the average investment in an MBO alongside DBAG Fund VI is

APPROXIMATELY

10,000,000

EUROS.

2011

Investment range expanded

With the DBAG Expansion Capital Fund (fund size incl. DBAG co-commitment: 242 million euros) DBAG again makes minority investments to provide growth capital to family businesses

2007

DBAG Fund V begins its investment phase

DBAG Fund V (fund size incl. DBAG co-commitment: 534 million euros) begins its investment phase; Deutsche Bank sells its last block of shares in DBAG

2002

First Buyout Fund with broad shareholder base

DBAG Fund IV (fund size incl. DBAG co-commitment: 328 million euros) with commitments by international investors in closed-end private equity funds outside DBAG's group of shareholders

2000

Decade of growth

Fivefold increase in portfolio value since 1990 to approximately 500 million euros

1997

New shareholder structure; first Management Buyouts

1987

German Private Equity legislation (Gesetz über Unternehmensbeteiligungs- gesellschaften)

DBAG classified as an equity investment company, the first company to receive this status

1985

Initial public offering of DBAG shares

Historic moment: DBAG’s IPO in 1985 makes private equity accessible to private shareholders.

1984

Deutsche Beteiligungs AG (DBAG) founded

The average investment in Mittelstand companies is

500,000

TO

2,500,000

DEUTSCHMARKS

at the time.

1975

DBG is the leader among german capital investment companies

Holding a market share of about 18 percent, DBG is the leader among German capital investment companies, with the German private equity market reaching a total value of nearly 420 million deutschmarks at year-end.

The new service soon met with demand: in 1966, Eberle-Werke, a family-owned company in Nuremberg, was the third investment after DBG’s foundation a year earlier.

1965

Pioneering role

Deutsche Beteiligungsgesellschaft mbH (DBG), a DBAG predecessor company, is founded by Deutsche Bank and other private banks with the objective of using equity capital investments to support the growth of medium-sized family-owned enterprises during the era of Germany’s “economic miracle”.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads