- Industry survey: attractive despite lower expected returns

- Focus on buy-and-build strategies and internationalisation

- “Secondaries offer a whole number of advantages, high proportion of primaries is still a competitive advantage”

Frankfurt am Main, Germany, 31 July 2018. Tapping into new customer groups and business fields as well as business internationalisation are the most promising value levers for private equity companies when acquiring a mid-market company as a second financial investor. But even in times characterised by a great deal of knowledge regarding different growth appreciation strategies, the return potential of so-called secondary and tertiary buyouts is lower than when a financial investor invests in a company for the first time. This is the conclusion drawn by the sixth Midmarket Private Equity Monitor, for which the magazine FINANCE, working on behalf of Deutsche Beteiligungs AG (DBAG), surveys investment managers at around 50 private equity firms operating in Germany every six months regarding trends in the German mid-market segment.

Nearly four out of five experts (79 percent) taking part in the latest survey said that secondary and tertiary buyouts in the mid-market segment promise lower returns than primaries – companies that have not previously belonged to another private equity firm. Nevertheless, transactions like these are currently in an upswing: last year, more than half of the buyouts in the German mid-market segment (19 out of 35 transactions) involved financial investors on the seller and the buyer side, setting a new record.

Given that more and more institutional investors are looking for investment opportunities, thereby fuelling mounting competition for investment targets, the high proportion of secondaries is hardly surprising. “These transactions are well established and accepted by the investors in our funds,” says Torsten Grede, Spokesman of the Board of Management of Deutsche Beteiligungs AG. “They point to the increasing maturity of the German private equity market and offer a number of advantages.” Grede continues, “Transactions between financial investors are often easier to structure because both partners know the market practices. The management team has already proven its entrepreneurial competence and has experience in corporate governance due to the presence of a private equity shareholder.”

85 percent of those surveyed said that the operational management within the company had already been improved before a secondary by way of KPI-based reporting. 64 percent observed that working capital had been reduced. The majority of the participants in the survey also said that procurement costs had already been reduced during the primary phase.

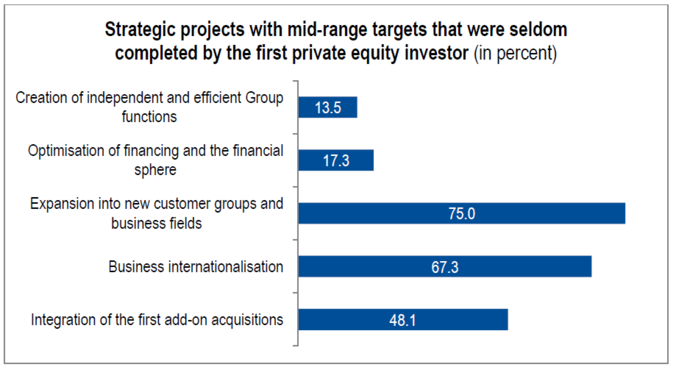

Nevertheless, there are still sufficient opportunities available for the second or even the third financial investor to advance the development of the companies. Strategies that used to be commonplace, such as financial engineering or company split-ups, have in any case long since fallen out of favour. “An increasing number of private equity companies have been focusing more heavily on complex value appreciation strategies,” said Spokesman of the DBAG Board of Management Grede. Three-quarters of the FINANCE panellists believe that the greatest potential for value appreciation in mid-market follow-up investments lies in expansion into new customer groups and business fields. 67 percent also cite the internationalisation of business as a value lever which is particularly well suited to secondaries. In addition, 48 percent said that the add-on acquisitions made under the auspices of the first private equity shareholder often still have to be integrated (see chart).

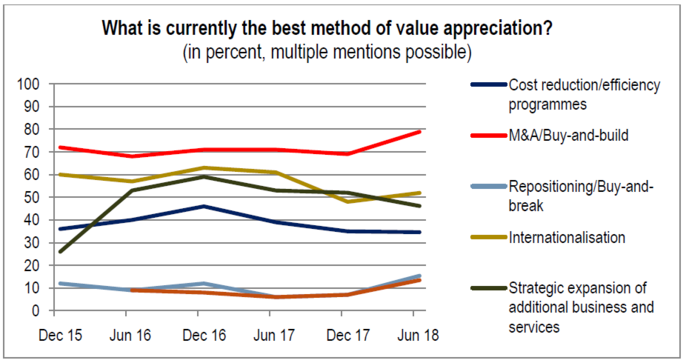

A look at the frequently asked questions shows that a large majority of firms also generally rely on buy-and-build strategies in the mid-market segment. At 79 percent, this continues to be the most highly rated method of value appreciation by far – regardless of whether it is used in the context of an initial or a follow-up investment. Private equity investors benefit from the fact that there are still many highly fragmented markets, particularly in the mid-market segment, in which strong market leaders with high levels of profitability can be established in a relatively short period of time through acquisitions. When acquisitions of smaller companies lead to lower valuations, this can cause the price of the whole transaction to fall. “This is also in response to the price development we have seen in recent years,” commented Spokesman of the DBAG Board of Management Grede, “and is representative of the private equity industry’s ability to adapt under changing market conditions.”

The longitudinal survey data also shows that, irrespective of the transaction type, internationalisation (currently cited by 52 percent of those surveyed) and the strategic expansion of additional business and services (46 percent) are still considered attractive, even at companies that have been owned by an investment company in the past.

Nevertheless, primaries still offer the most opportunities for initiating strategic further development and realising potential for value appreciation. “Those players that can conclude as many of these transactions as possible have the edge over their competitors,” says Board of Management Spokesman Grede. DBAG has structured five buyouts over the last twelve months. Four of them were primaries and were sold by the respective company founders. The fifth new investment involved a company that had already been in the hands of other financial investors in the past.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads