The ‘Mittelstand’ has voted clearly, and private equity has finally arrived. The willingness to work with private equity investors has never been greater. In 2022, there were 43 transactions, which is less than in the previous year, but the trend is unbreakable positive, as this level is still above the ten-year average of 39 MBOs per year. And of those, more than 60 per cent were company founders or families. No wonder, after all, the succession issue is one of the most pressing; according to a KfW study, around 560,000 SMEs are planning a succession arrangement by 2026. At the same time, having one's own company is one of the greatest achievements made and an essential part of the life story of founders. So how to connect the dots here? The model of re-investment is the ideal way, as it offers the opportunity to use the value enhancement strategies of private equity and at the same time to further participate in the potential of the company.

Re-investment as an opportunity: alignment of interests

In the case of a re-investment, the existing shareholder sells his shares to a private equity company and reinvests via an acquisition company (NewCo) established by the financial investor. The advantage is that the seller can convert the majority of the assets tied up in the company into liquidity and thus diversify its own asset structure. This is particularly interesting in terms of a possible retirement provision, especially in these times. In unison, the former shareholders can participate in the growth of the company through the return participation. With the help of the financial investor, the company can be developed further, for example through acquisitions.

The seller's re-investment demonstrates confidence in the company's potential; this strengthens the trust of customers and employees. In addition, the know-how of the seller is retained, especially if the previous shareholder remains associated with the company as a member of the advisory board or supervisory board or continues to be active in the company as a managing director. After all, the entrepreneur knows the business inside out and has an established network. Maintaining this after the sale is an important success factor.

Another argument in favor of the re-investment model can be different price expectations. Uncertain business projections exacerbate this and often lead to differing expectations about the future development of the company. This is where a balance of interests is required: the investor pays a purchase price that he believes is equal to the risks and allows the seller to participate in the future increase in the value of the company via a return share in the equity. In contrast to other instruments for bridging divergent purchase price expectations, such as earn-out clauses, a re-investment ensures that the interests of the financial investor and the existing shareholder are aligned. The participation takes place on the same terms, the financial investor and the co-shareholder jointly bear the entrepreneurial opportunities and risks in proportion to their shares.

Re-investment as an opportunity: A wide range of options

A re-investment can be structured in various ways, depending on the preferences of the former shareholder. For example, the amount can differ. Fixed-interest seller loans, in which the seller defers all or part of the purchase price to the buyer, are also possible. In addition, tax aspects are taken into account in the structuring.

Re-investment as an opportunity: examples in the DBAG portfolio

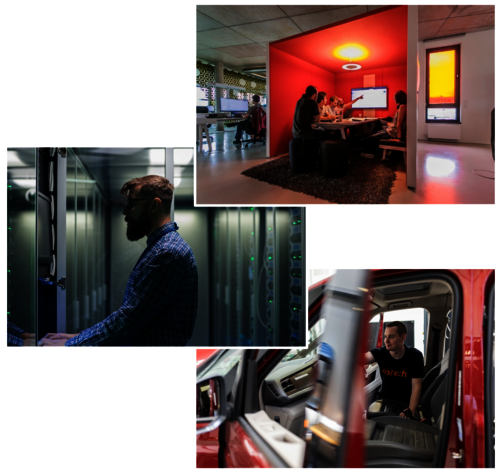

Because of their flexible structuring options, re-investments are suitable for a wide variety of corporate situations. Numerous examples from DBAG's portfolio illustrate the diversity: In one portfolio company, the minority shareholder of an industrial company was able to succeed the previous majority shareholder with the help of DBAG. Examples of re-investments from the DBAG portfolio are freiheit.com, akquinet and in-tech. The latter is a fast-growing technology company for engineering services and software. The company has reported average revenue growth rates of 13 per cent over the past five years, with excellent market projections. These are driven by macro trends such as the “software-defined vehicle”, autonomous driving, electrification, and “shared mobility”.

Due to the re-investments model, both the existing shareholders, the management and the investor are taken into account. At the same time, all parties benefit because they are pulling in the same direction with the aim of achieving a sustainable increase in value.

Newsletter

Newsletter

Contact

Contact

Downloads

Downloads