“Challenges are also just thorny opportunities”, Germany’s current Federal Minister of Finance observed long before he became a professional politician. And that is exactly what the private equity market is demonstrating, as confirmed by FINANCE’s latest Midmarket Private Equity Monitor. The journal, in cooperation with Deutsche Beteiligungs AG (DBAG), regularly conducts an anonymous survey of investment managers working for mid-market private equity companies to ask about things like sentiment on the M&A market. Despite prevailing macroeconomic conditions, the survey’s conclusion is that the small and mid-cap segment stood out due to high activity.

Having entered into five new investments last year and realising six disposals (including one partial disposal), DBAG was a driver behind this positive development. “The past year was marked by macroeconomic challenges that are set to persist throughout this year. Nonetheless, we succeeded in securing many attractive opportunities for our Company, our fund investors and our shareholders, underlining the fact that the smallcap/mid-cap segment was again characterised by strong activity last year. With its six disposals and five new investments, DBAG made a significant contribution to the segment’s buoyancy in the 2022/2023 financial year”, said Tom Alzin, Spokesman of the Board of Management of Deutsche Beteiligungs AG.

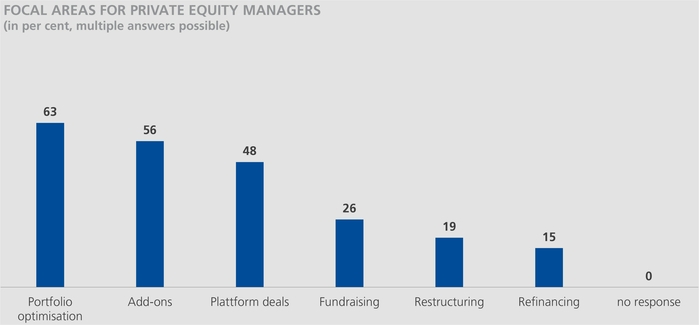

Private equity focuses on portfolio optimisation

Value creation: Buy-and-build strategies at the forefront

When it comes to the preferred method of creating value, the Buy-and-build strategy is still considered the tool of choice, as reported by 79 per cent of the surveyed investment managers in June of the previous year. In the latest survey, that number increased even further to 81 per cent. Portfolio companies naturally also benefit from DBAG team’s extensive M&A experience. In the 2022/2023 financial year, the Company was able to agree twelve add-on acquisitions. “In a highly fragmented market, for example, the Buy-and-build strategy helps us to realise extensive synergy potential while expanding both the customer and expertise base. And much more efficiently than would be possible organically in many cases. So, acquisitions play a relevant role in our portfolio”, explains Jannick Hunecke, Member of the Board of Management of Deutsche Beteiligungs AG.

The Buy-and-build strategy is followed by efficiency enhancements (63 per cent) in the ranking of the most popular ways to create value. In addition, geographic expansion is a proven means for 44 per cent of respondents, with the development of new business areas and the introduction of new products and services (11 per cent) coming in last.

The full study can be found on Finance-Magazin.de.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads