Greater focus on harmful emissions, employee satisfaction and gender equality

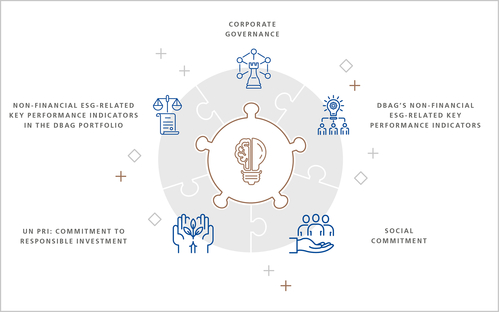

DBAG is integrating environmental and social aspects as well as the ambition for good corporate governance even more firmly into its business activities. The Bank’s existing ESG Policy, in place since 2014, has now been extended to include additional issues. The Policy, published on the website, describes DBAG’s commitment to sustainability in general and its approach to integrating sustainability aspects into the overall investment process. Moreover, it outlines DBAG’s expectations and standards as to how it works with its portfolio companies in the context of sustainability.

Important additions relate to the recording of harmful greenhouse gas emissions, ascertaining employee satisfaction and achieving gender equality. The standards on corporate governance remain largely unchanged: According to Torsten Grede, Spokesman of the Board of Management, “much of what is now being advocated under the heading of ESG corresponds to the ethical standards that have always been part of our corporate culture.” This applies, for example, to the ‘zero tolerance’ approach adopted by DBAG and the portfolio companies it manages with regard to compliance with legal regulations. DBAG is strictly opposed to all forms of corruption and other unethical business practices. To meet these high compliance standards both within DBAG and in its dealings with the portfolio companies, a far-reaching compliance system was introduced in 2012, including mandatory annual training for all DBAG employees and a whistle-blower system.

ESG criteria are becoming more and more important for the availability of capital. For example, investors in DBAG funds are increasingly tying their capital commitments to compliance with ESG criteria within DBAG’s investment process. They are increasingly expecting a high level of commitment. The same applies to investors on the equity market. With its Taxonomy Regulation, the European Union crowns certain endeavours as ‘green’ investments. Finally, banks offer interest rate benefits for debt financings if certain ESG-related criteria are met. As such, this development is affecting DBAG on several levels.

It is particularly relevant to the portfolio companies. ESG criteria are therefore an integral part of any due diligence process. Given how crucial it is for the business success of both DBAG and the portfolio companies to anchor sustainability aspects in their value enhancement strategy, investment proposals should include a careful consideration of opportunities and risks arising from ESG (core) issues identified during the due diligence process. Throughout the investment phase, specific action should be taken to improve ESG performance. For this to happen, meaningful qualitative and quantitative ESG performance indicators need to be defined that allow performance to be measured on general and core company-specific ESG aspects. Most existing portfolio companies have already defined these indicators over the past year.

The ESG Policy also includes a list of business activities that should not be invested in if the companies in question generate more than 20 per cent of their revenues from them. These include gambling and coal and uranium mining, for example.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads