After a veritable deal engine has been fired up, the market environment for private equity is shifting down a gear, at least that is the reading in the new FINANCE Midmarket Private Equity Monitor. Together with Deutsche Beteiligungs AG (DBAG), the trade magazine regularly surveys anonymously the investment managers of midmarket private equity firms, among other things also about the mood on the M&A market. It is interesting to note, especially in the light of the extensive new investments of recent years, that while 45 per cent of those surveyed say they have a "great appetite for exits", 45 per cent also say they feel a "low" need for disposals — regardless of this, the industry is in a challenging market environment.

Nevertheless, DBAG has succeeded in making attractive disposals. "We were able to structure four disposals in the first half of our current fiscal year and have agreed on one another. This underscores the robustness of our strategy and our team, and proves that we can create attractive sales conditions for our portfolio companies even in difficult market situations," explains Tom Alzin, Spokesman of the Board of Management of Deutsche Beteiligungs AG.

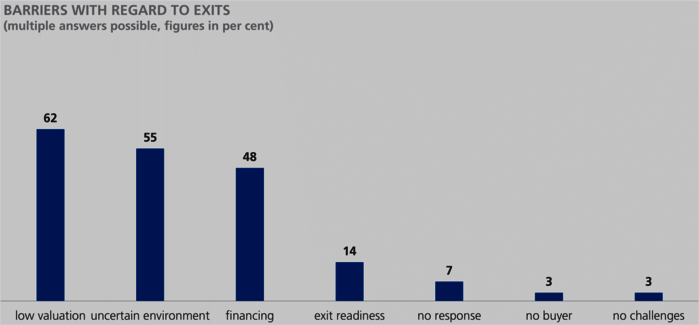

Company valuations as the biggest hurdle

According to the study participants, the biggest challenges in a context of disposals are mixed. Thus, by multiple responses, 62 per cent stated that valuations were too low, 55 per cent felt that the market environment was too uncertain, and 48 per cent complained about access to financing. Only three percent of investment managers surveyed said there are "no buyers." Of the disposals that could be realised, 55 per cent went to strategists, and only 17 per cent went to a financial investor as part of a secondary.

Competition remains strong

Study participants rated competition among private equity investors on a scale of 1 to 10, with 10 representing strong competition. Rivalry within the industry is rated at 7.3 in the current survey. Although the sense of competition was slightly lower in a direct comparison with the June 2022 survey (8.03), the score is still at a high level, though slightly below the multi-year average of 8.1. Separately, the investment managers surveyed consider industrial holding companies to be their biggest competitors, with a full 66 per cent seeing it that way. This figure has been similar for several editions of the survey. However, there was a substantial change among family offices, which closely follow the group of industrial holding companies. 59 per cent consider them to be competitors for exciting target companies. This figure is up 9 per cent from the December 2022 survey, but over the long term, this trend is down (68 per cent); in the June 2022 survey, as many as 84 per cent of respondents said that industrial family asset managers are private equity's biggest competitor.

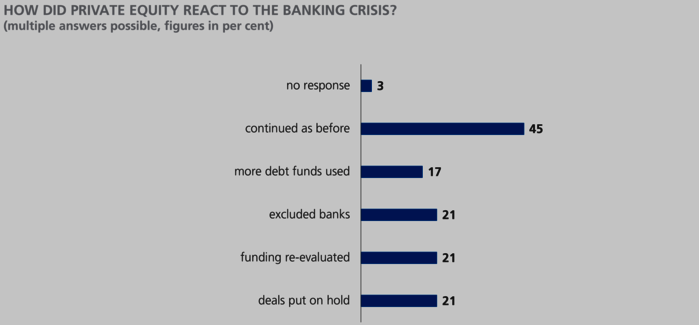

Here's how private equity is responding to the banking crisis

What impact have the recent events surrounding several banks at once had on the private equity industry? The question of reaction is clear — a full 45 per cent of study participants said they had continued to operate as they had before, regardless of the banking crisis. Nevertheless, there were exceptions: In response to this question, where multiple responses were possible, 21 per cent of respondents said they had excluded certain banks from existing financings, a round fifth had re-evaluated financings, and another fifth had paused transactions for a short time. It is also interesting to note the conclusions drawn by the investment managers surveyed. For example, the majority (55 per cent) expect stricter requirements for banks. 34 percent assume that the events will affect the reputation of banks, and 17 per cent think that private equity will become more attractive as an asset class.

Value enhancement: buy-and-build strategy remains favorite

When it comes to value enhancement, "buy and build" remains the most important method. A convincing 79 per cent of respondents stated this accordingly. While it was still 73 per cent in December 2022, this figure has actually risen somewhat. Jannick Hunecke, member of the Board of Management of Deutsche Beteiligungs AG, explains: “Utilizing ‘Buy and build’ can pave the way to take advantage of macroeconomic situations, for example in a context of consolidations. We were able to structure 28 add-on acquisitions within our portfolio in our past financial year. The success of this strategy is also reflected in our recently raised guidance for our 2022/2023 financial year.” In addition, measures to increase efficiency as well as reduce costs are also popular as a tool to increase value (55 per cent).

You can find the complete study at Finance-Magazin.de.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads