- Buyout market shifted down a gear in 2022

- IT services and software see strong increases

- Torsten Grede, Spokesman of the DBAG Board of Management: “The buyout market will pick up speed again”

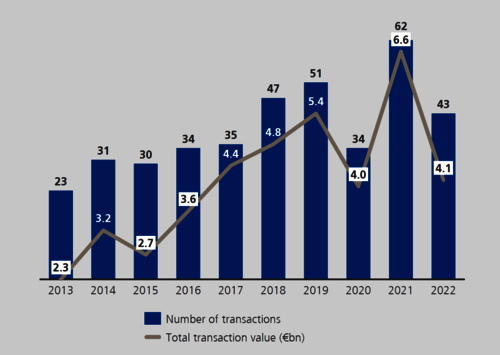

Frankfurt/Main, 26 January 2023. The German mid-market buyout segment shifted down a gear in 2022. Financial investors structured 43 management buyouts (MBOs), one-third fewer than the year before. The market volume fell to 4.1 billion euros, compared with 6.6 billion euros in 2021. “The combination of war in Ukraine, soaring energy costs, inflation and higher interest rates really put the M&A market under pressure,” said Torsten Grede, Spokesman of the Board of Management of Deutsche Beteiligungs AG (DBAG), commenting on market developments. Some developments already observed in 2021 continued: primaries – transactions not executed between financial investors – accounted for a high share of the total. “This is evidence of just how healthy the German MBO market is. Other developed markets are dominated by secondaries,” Mr Grede said. Moreover, the IT services and software sectors now account for an even larger proportion of mid-market MBOs.

Financial investors structured 43 MBO transactions in the German Mittelstand last year, or 19 fewer than in 2021. This is still higher than the ten-year average of 39 MBOs and more than the figure of 34 MBOs in the Covid year 2020. Founders or family owners sold to financial investors in 27 out of the 43 transactions. This often also involved handing over company management to successors. Transactions with families and founders as sellers had already represented more than half of all transactions in the previous year. One buyout was the result of a larger group spinning out peripheral businesses to a financial investor. The remaining 15 MBOs were agreed upon between financial investors. Over the long term, the buyout market in the German Mittelstand is growing at an average annual rate of around seven per cent (CAGR 2013-2022).

This analysis only includes transactions in which financial investors acquired a majority stake alongside company management, and which had a transaction value for the financial debt-free company (enterprise value) of 50 to 250 million euros. This information was compiled from publicly available sources, together with estimates and research by DBAG in cooperation with the German industry magazine FINANCE.

IT services and software see strong increases

The IT services and software sector continued to become more popular with German mid-market financial investors. A total of 16 transactions took place in this sector in 2022, more than a third of all MBOs in the year and significantly higher than the ten-year average of 17 per cent. “This trend is reflected in the DBAG portfolio, too: the share of companies from the IT services and software sector as a proportion of the entire DBAG portfolio has gone up fourfold in the past two years,” Mr Grede explained.

Is the worst over yet?

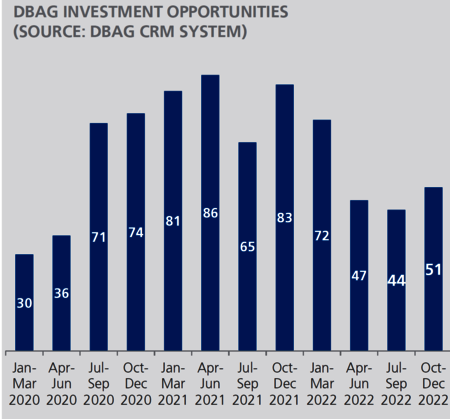

Yet this decline in the German mid-market buyout sector might already have bottomed out. Investment opportunities recorded in DBAG’s internal CRM system for the period October to December 2022 increased slightly to a total of 51, up from just 44 investment opportunities for the period July to September 2022. “We are seeing a slight recovery here. We are convinced that the buyout market will pick up momentum in 2023,” Mr Grede commented on recent developments.

Competition remains tough in a structural growth market

Transactions were split among a large number of financial investors in 2022. “Competition is still tough, which underlines how attractive MBOs in the German mid-market segment are,” said Torsten Grede commenting on the competitive situation. 30 private equity firms were involved in the 43 transactions observed last year. DBAG figures in the buyout list with two MBOs in 2022 (previous year: three out of 62). It did complete an additional MBO in 2022, but this was not included in the analysis because the company was based in Italy. Over the past ten years DBAG has the highest market share in a fragmented market, with 26 of 390 MBOs (seven per cent); it is followed in the ranking by two competitors with 22 and 18 transactions respectively in the market segment under review.

Contact

Contact

Newsletter

Newsletter

Downloads

Downloads