Team

Jan Quandt

Jannick Hunecke

Born in 1974, Member of the Board of Management since March 2021; appointed until end of February 2031.

Jannick Hunecke joined Deutsche Beteiligungs AG in 2001 and became a Managing Director in 2008. He has 25 years of experience in the private equity business.

Jannick Hunecke holds a degree in Business Administration from the University of Munster.

Maximilian Hegel

Maximilian Hegel joined Deutsche Beteiligungs AG in 2014.

He has ten years of experience in the private equity sector.

Maximilian Hegel holds a Bachelor of Science in Business Administration from the WHU – Otto Beisheim School of Management, and a Master of Science in Management from the University of Mannheim. He also studied at the Olin Business School at Washington University, St Louis, and at Bentley University, Boston.

Dario Alessandro

Dario Alessandro joined DBAG Italia in 2022.

Before joining DBAG Italia he worked at Goldman Sachs and Investindustrial as an Associate. Dario Alessandro has five years of experience in the private equity sector.

Dario Alessandro holds a Bachelor of Science in Economics and Management from Luiss University, Rome, and a Master of Science in Finance from Bocconi University, Milan.

Our core objective:

Sustainable increase in the company’s value

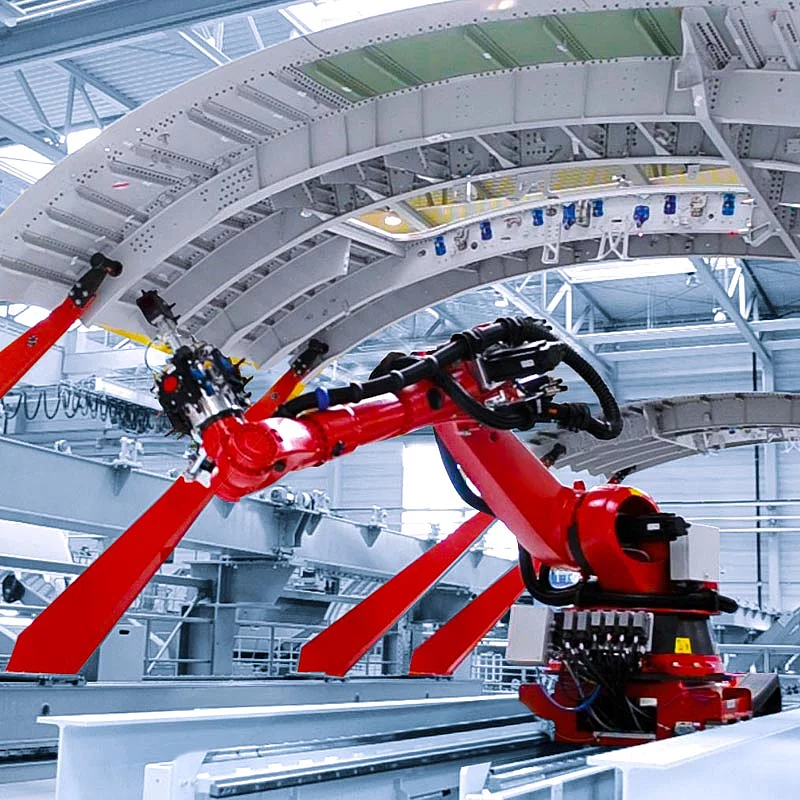

Investments in well-positioned mid-sized companies with development potential

Funds

Sustainability

We assume responsibility for the impact our decisions have on others – now and in the future. We align our actions and behaviour accordingly in the way we manage our Company, and especially in the way we carry out the investment process in (as well as the development and later disposal of) our portfolio companies.

Contact

Thomas Weber

Thomas Weber joined DBAG in 2014 and is Head of Business Development.

Previously, Thomas Weber served at PwC, Commerzbank and Concept Consulting, a mid-market consultancy firm. In addition to business development, he focused on human resources.

Thomas Weber holds a degree in Law from the Goethe University, Frankfurt.

Three questions for Thomas Weber

Our shareholders and the investors in DBAG funds have entrusted capital to us. They expect us to invest it in promising companies. For that reason, it is important that we have, qualitatively and quantitatively, a well-filled pipeline of attractive investment opportunities at all times. That requires an entire range of marketing activities: out of some 300 investment opportunities, transaction ideas or offers, we result four to six corporate investments each year.

Directing this process is one of my key responsibilities. My colleagues on the investment team are frequently working to full capacity on their primary assignment, the accomplishment of transactions. I therefore organise the collaboration with investment banks and M&A consultants and look for platforms for interacting with capital-seeking companies.

Beyond that, I attend to our network of industrial experts, which mostly consists of former board members and CEOs experienced in the sectors we invest in. They support our team by contributing their knowledge. This network needs to change constantly to maintain its effectiveness and I am responsible for steering that transition.

Furthermore, even a private equity company must engage in marketing. The Business Development Manager represents Deutsche Beteiligungs AG at events or fairs and communicates its investment strategy to the market. This allows me to further support DBAG’s market communication and presence.

To us, an industrial expert is someone who, thanks to his or her in-depth knowledge of the industry, backs us in preparing investment decisions and supporting portfolio companies. Industrial experts advise the investment team as it analyses potential investments and they provide support as a strategy is developed for each of the companies. In addition, seats on supervisory boards or advisory councils are often filled by industrial experts.

If you have a proven track record successfully managing a large internationally operating company in one of our relevant sectors and if working entrepreneurially remains appealing to you, then feel free to contact me.

We are known for successful investments in Mittelstand enterprises. In addition to our longstanding market presence from which we have gained extensive experience, we have a focused investment strategy and a high level of transparency. Beyond that, what sets us apart is our proven expertise in Germany’s Mittelstand across various sectors. With individual equity capital solutions ranging from 10 to 200 million euros, we offer a broad spectrum of solutions for mid-sized companies.

We consider ourselves to be strategic partners to our portfolio companies, and it is important for us that we have trusting, reliable relationships with all of a company’s stakeholders.

Newsletter

Newsletter

Contact

Contact  Downloads

Downloads  Newsletter

Newsletter