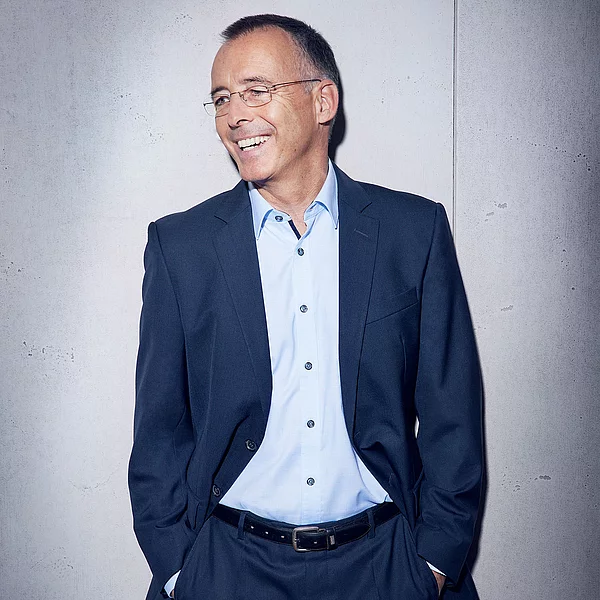

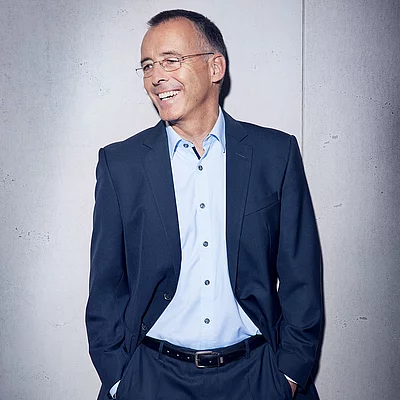

Bernd Sexauer was initially with Deutsche Beteiligungs AG from 1991 to 2006 and became a Managing Director in 1998. Since his return in 2012, he has been strengthening the team at Deutsche Beteiligungs AG once more.

Prior to entering private equity practice, he earned a degree in Business Administration from Goethe University, Frankfurt. From 2006 to 2012 he was Managing Director at DZ Equity Partner and at Prolimity Capital Partners, and CEO of publicly listed Heliad Equity Partners.

Bernd Sexauer has more than 30 years of experience in the investment business and in corporate finance. As a member of supervisory boards, advisory councils and other governance bodies he has supported 'Mittelstand' companies in numerous transactions. He has a wealth of knowledge especially of the automotive supplier sector, which he was able to apply for the investment in Oechsler.

Newsletter

Newsletter

Contact

Contact  Downloads

Downloads  Newsletter

Newsletter